Sustainable and Responsible Investment

3.1 Sustainable and Responsible Investment

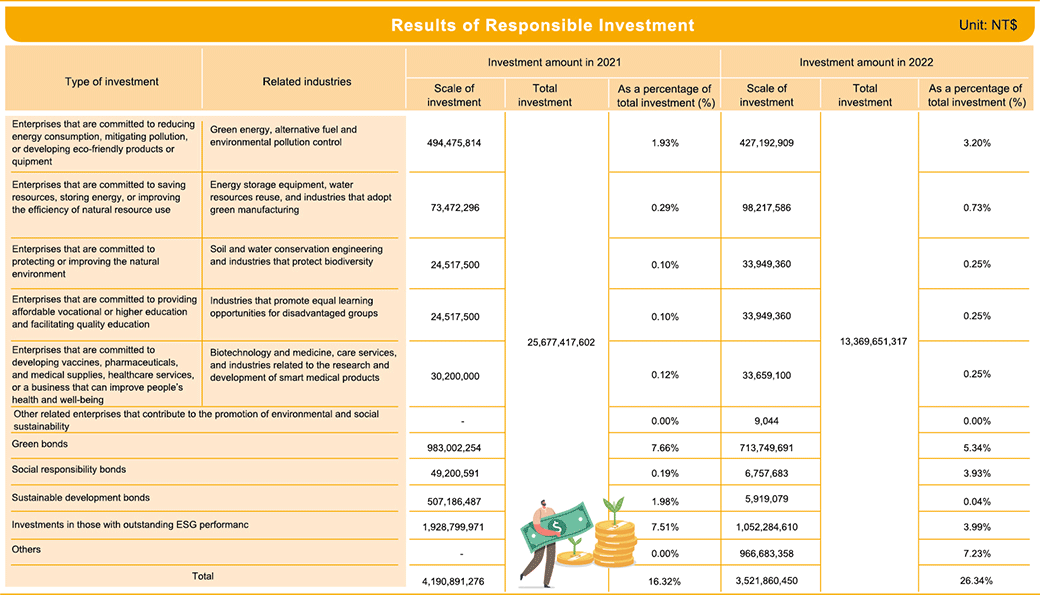

Following international trends and regulatory initiatives, sustainable finance-related policies and implementation methods have become increasingly highlighted for their importance. PSC has incorporated the notion of responsible investment into its investment policies, requiring proprietary and underwriting units to consider and assess ESG risk factors (including environmental, social, and governance aspects) when making investment decisions. Furthermore, we have integrated ESG elements into our operational procedures for investment decision-making and asset management to ensure proper implementation and adherence to our sustainable finance guidelines.

In 2022, PSC established the "ESG Investment Management Policy," which mandates that, for domestically invested companies without short positions, a pre-investment evaluation should be conducted using external databases and ESG indicators to identify risks. After investment, the ESG performance of the investment portfolio during the holding period is regularly reviewed, and the ESG exposure of the investment targets is further analyzed. By doing so, the Company is able to solidify its commitment to sustainable finance and fully integrate ESG elements into investment policies to leverage financial influence.

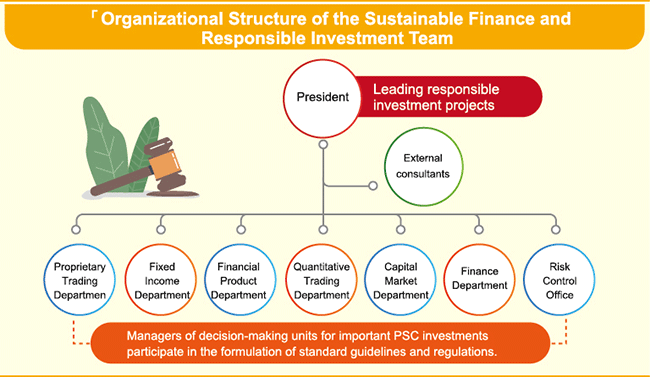

3.1.1 Governance Organization of Responsible Investment

PSC’s Sustainable Finance and Responsible Investment Team is led by the President and engages external consultants to collaborate on planning and policy implementation, such as conducting training on sustainable finance responsible investment and updating investment policies as required by regulations. Members of the team comprise key decision-makers in investment and fund management units within the Company, such as managers and project representatives of the Financial Product Department, Capital Market Department, and Risk Control Office. Through cross-departmental coordination and role assignment, the team works to implement the responsible investment policy and helps regulate the Company's investment units, ensuring that they reference the six principles of the United Nations Principles for Responsible Investment (UN PRI) and incorporate ESG risk factors (including environmental, social, and governance aspects) into their investment decision assessment criteria when utilizing the Company's proprietary funds

3.1.2 Sustainable Finance Guidelines

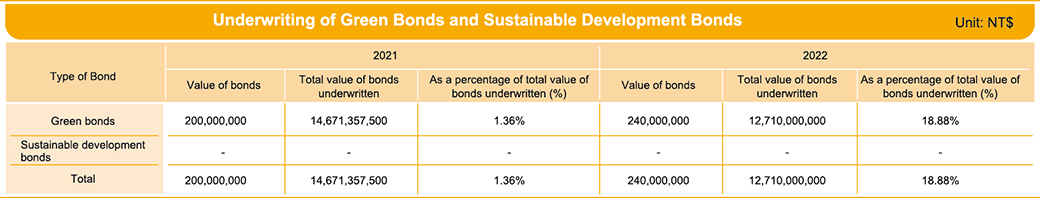

PSC is committed to the implementation of sustainable finance guidelines. We incorporate environmental and social risk assessments into investment and underwriting and formulate principlebased frameworks and guidelines to ensure effective implementation of sustainable finance internally. The guidelines are also abided by in various business operations to achieve PSC’s sustainable business goals, thereby enhancing the long-term values for stakeholders, such as clients, employees, and shareholders. Meanwhile, we remain in line with international sustainable development trends as we fulfill our responsibilities as a global citizen.

Sustainable Finance Guidelines

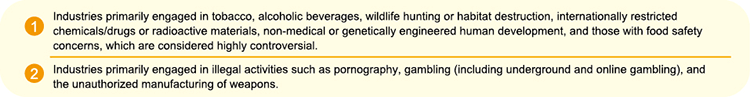

PSC has set out business promotion and product development principles and specified industries or companies with positive prospects for sustainable development in the Sustainable Finance Guidelines so that we can actively support their investment applications and underwriting activities. The guidelines guide us to support alternative energy, environmental pollution control, or environmental product or technology R&D industries, social charity industries that provide high-quality education, and relevant enterprises that contribute to the environmental and social sustainability. Regarding industries or enterprises with controversial issues, such as highly controversial or illegal activities, we should conduct an investment review and prudent evaluation of their investment applications or underwriting activities, thereby mitigating the risk of their material adverse impact on the environment, society, governance, and sustainable development.

Under the investment principles mentioned above, PSC will evaluate the feasibility of investments based on practical operations. Only after a comprehensive review process will investments be considered, and control measures will be implemented after the investment has been made.

ESG Product Development

President TIP FactSet Taiwan Smart Mobility and Electric Vehicles Total Return Index ETN (020030)

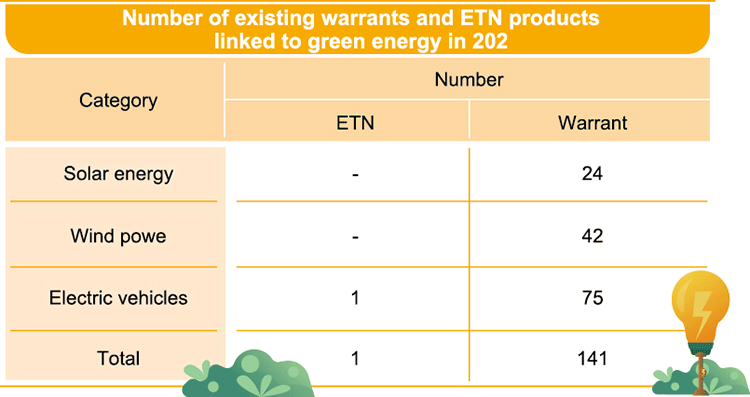

In recent years, as the global awareness of environmental protection rises, relevant carbon reduction issues have emerged. The decline of fossil fuel vehicles is inevitable, but the future evolution of mobility is not only limited to changes in energy consumption patterns. Instead, smart mobility driven by digital intelligence is the key to accelerating new generation advancement. PSC launched the President TIP FactSet Taiwan Smart Mobility and Electric Vehicles Total Return Index ETN (020030), which motivates customers to stay relevant to the emerging development of electric vehicles in the wake of declining fossil fuel vehicles and the new smart mobility industry by investing in well-performing stocks of Taiwan-listed and OTC electric vehicle technology and service providers, automotive manufacturers and auto parts companies. In 2022, there were roughly 74,000 lots of the ETNs outstanding in a total amount of approximately NT$ 270 million.

Green Energy-Linked Warrants

As governments and businesses are increasingly pivoting toward energy transformation, the green energy industry prospered. PSC has actively issued linked warrants to green energy stocks, providing investors with the opportunity to not only engage in green energy and environmental protection but also seize investment opportunities in financial products linked with the growing green energy sector. In 2022, the Company issued a total of 141 green energy-linked warrants.

Industry Guidelines

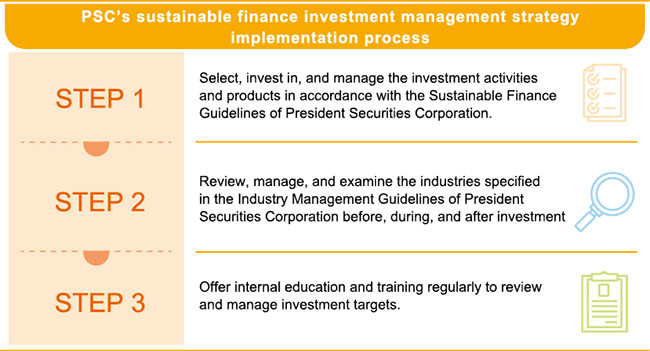

The Company screened out the top industries (metals and mining, oil, natural gas, consumer fuels, energy facilities, and service industries) exposed to greatest risks in accordance with applicable domestic laws and regulations and with reference to international standards, while reviewing, managing, and examining the management processes and capabilities for the environmental and social risks that may arise from the aforementioned industries, to ensure the controllability of the Company's investment risks.

ESG Investment Management Policy

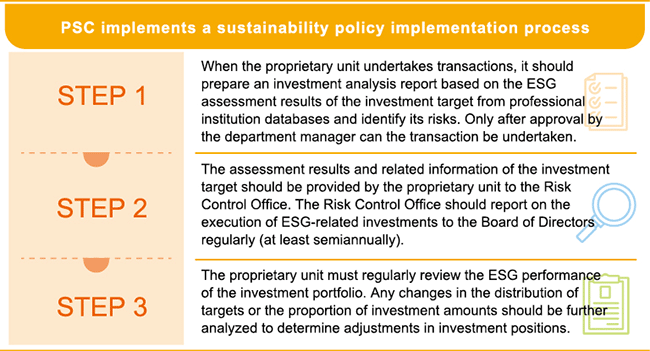

In 2022, PSC formulated the ESG Investment Management Policy in accordance with the SelfRegulation Agreement of the Securities Association and the Securities and Futures Industry Sustainable Development Transformation Implementation Strategy. This policy takes into consideration whether the investee companies fulfill corporate governance, environmental protection, and social responsibility. It also involves continuous monitoring and management of the ESG-related risk exposure level of the investment targets based on ratings of external databases. The Company is committed to implementing a sustainable development policy through the following steps.

Review of Sustainability Products and Services

The financial product review process at PSC follows relevant regulations based on business categories. After internal reviews to ensure there are no false or inappropriate statements, and upon obtaining approval from the competent authority, the products are eligible for listing. We have also incorporated ESG principles into the evaluation criteria and review process for products and services. Through a comprehensive assessment procedure, priority is given to products and services that align with ESG factors and have no significant negative controversies, which is a reflection of PSC’s commitment to sustainable financial services and stewardship. While providing customers with investment opportunities in sustainable financial products, product risks are reduced as well.

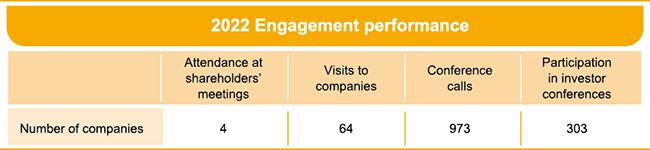

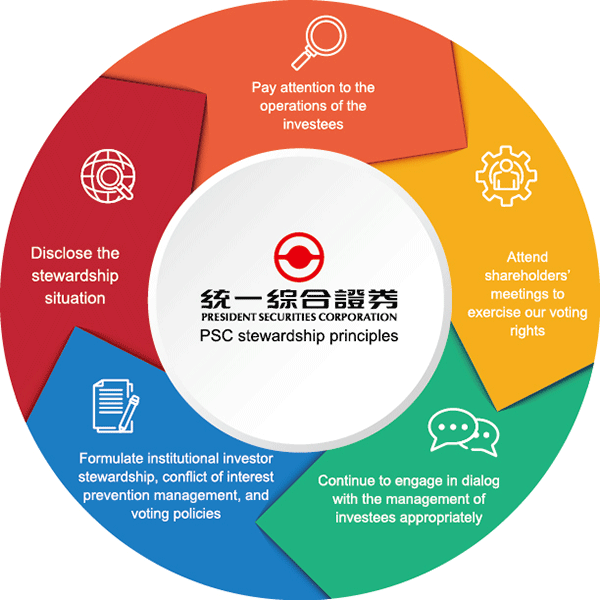

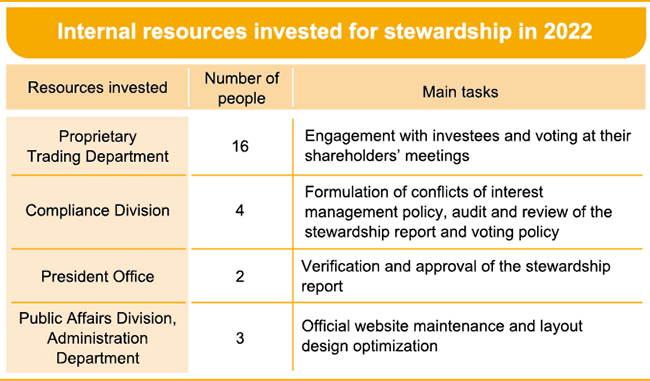

3.1.3 Institutional Investor's Stewardship

As an institutional investor, PSC is committed to upholding the principles of corporate governance and assumes related responsibilities. In accordance with the Stewardship Principles for Institutional Investors published by the Taiwan Stock Exchange and the goal of enhancing the number of signatories to the Stewardship Principles for Institutional Investors and the quality of stewardship information disclosure specified in the New Corporate Governance Roadmap launched by the Financial Supervisory Commission (FSC), PSC has published this year’s Stewardship Report and publicly disclosed relevant information. The Company also actively engages in dialogue and communication processes with investee companies, aiming to stay informed of the operational and governance status of these companies through the exercise of voting rights at shareholders’ meeting and ongoing dialogue with the management of investee companies.

Furthermore, PSC incorporated sustainable stewardship principles into its ESG Investment Management Policy in 2022. As the Company continues to enact stewardship practices and closely monitors developments in sustainability-related issues, we also remain attentive to changes in domestic and international sustainability regulations and consider variations in corporate operating models and the environment in Taiwan. All of these efforts reflect PSC’s commitment to practicing sustainable business and development.