Responsibility Management

2.1 Corporate Governance

2.1.1 Corporate Governance Overview

PSC has a comprehensive and rigorous board governance system and various functional committees. Through a sound corporate management system, the Company’s board members and independent directors are able to fully perform their supervisory duties, offering the Company guidance toward achieving excellent performance and meeting the expectations of various stakeholders.

Information Disclosure and Transparency Ranking

PSC participates in the annual information disclosure evaluation by the Securities and Futures Bureau as jointly commissioned by Taiwan Stock Exchange and Taipei Exchange. There are five categories of evaluation, namely the timeliness of information disclosures, financial forecast disclosures, annual report information disclosures (including financial and operational information transparency, the board of directors, and shareholding structure), corporate official website, and compliance disclosures. PSC discloses a variety of information, annual reports, information on the official website in compliance with laws and regulations in an accurate, timely, and disciplined manner through the Finance Department and various units. We have participated in this evaluation 12 times from 2003 to 2014. Except that the evaluation in 2003, in which we were not rated by the organizer, and the evaluation in 2004, in which we were ranked among the top one third of all participants, we have been ranked as “Grade A” or above from 2005 through 2014 as a company with more transparent voluntary disclosures and have been awarded the best rating eight times.

Corporate Governance Evaluation

The Company is the only publicly listed securities firm that has ranked among the top 5% (level 1) of all participants in the corporate governance evaluation for three consecutive years.

The Taiwan Stock Exchange has conducted corporate governance evaluation since 2013 as per its corporate governance blueprint. The evaluation indicators are divided into the five major dimensions of protection of shareholders' rights and interests, equal treatment of shareholders, strengthening of the structure and operations of the board of directors, improvement to information transparency, implementation of corporate governance, fulfillment of social responsibility. PSC has obtained high scores over the years, and our score in the 9th Corporate Governance Evaluation in 2022 was 92.93. For other issues to be improved, we are actively developing an improvement plan. For example, we will make adjustments to the seats of independent directors, the timing of shareholders’ meetings, and climate risk disclosures. In addition, the Company obtained the ISO 14001 environmental management system certification on June 14, 2022. We will remain attentive to issues related to environmental pollution, low resource utilization and efficiency, inappropriate waste management, and climate change, striving to achieve information transparency, deliver corporate social responsibility and enhance our sustainable development goals.

2.1.2 Board of Directors Structure and Operation

Board of Directors Structure

PSC has established the Board of Directors as the highest governing body in accordance with the Articles of Incorporation. The board consists of 19 directors, including 4 independent and 15 nonindependent directors, and convenes at least once per quarter. To establish a sound governance system of the Board of Directors, improve the supervisory function, and reinforce the management function, we have formulated the Rules of the Procedure for Board of Directors Meetings of President Securities Corporation in accordance with Article 2 of the Regulations Governing Procedure for Board of Directors Meetings of Public Companies.

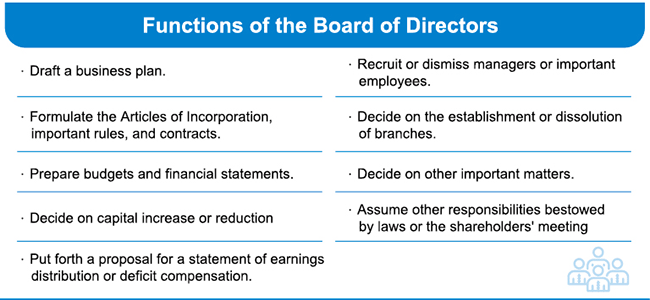

The board of directors shall have the following functions:

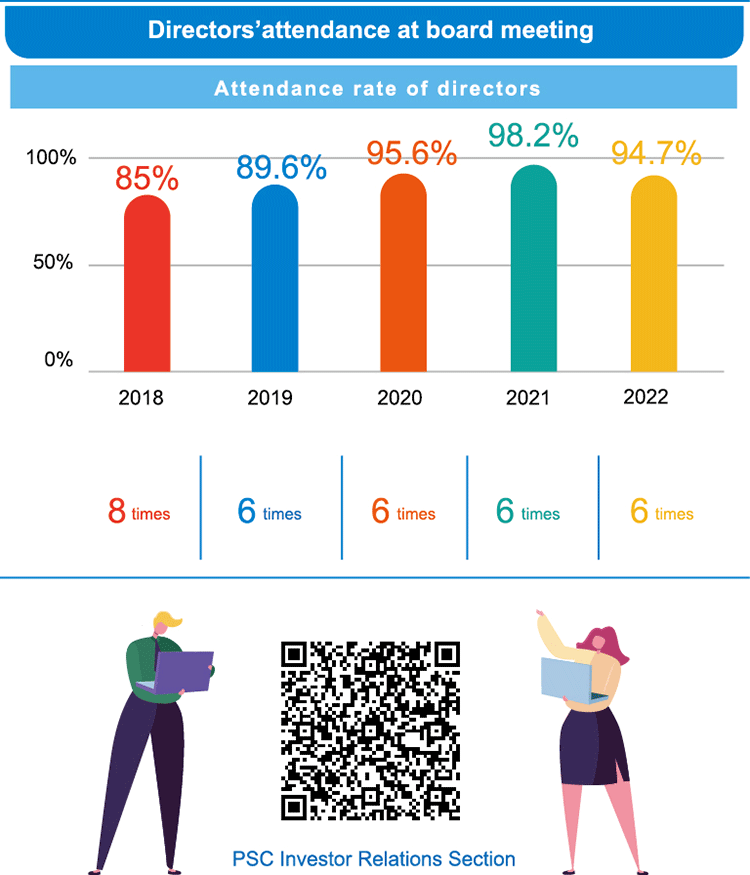

Operations of the Board of Directors

We held a total of six board meetings in 2022. The directors’ and independent directors’ overall attendance was 94.7% (100% if attendance by proxy was included). The independent directors’ attendance was 95.8%. The board meeting minutes are placed in the Investor section of the Company's official website, and the resolutions adopted at the meetings are listed and tracked.

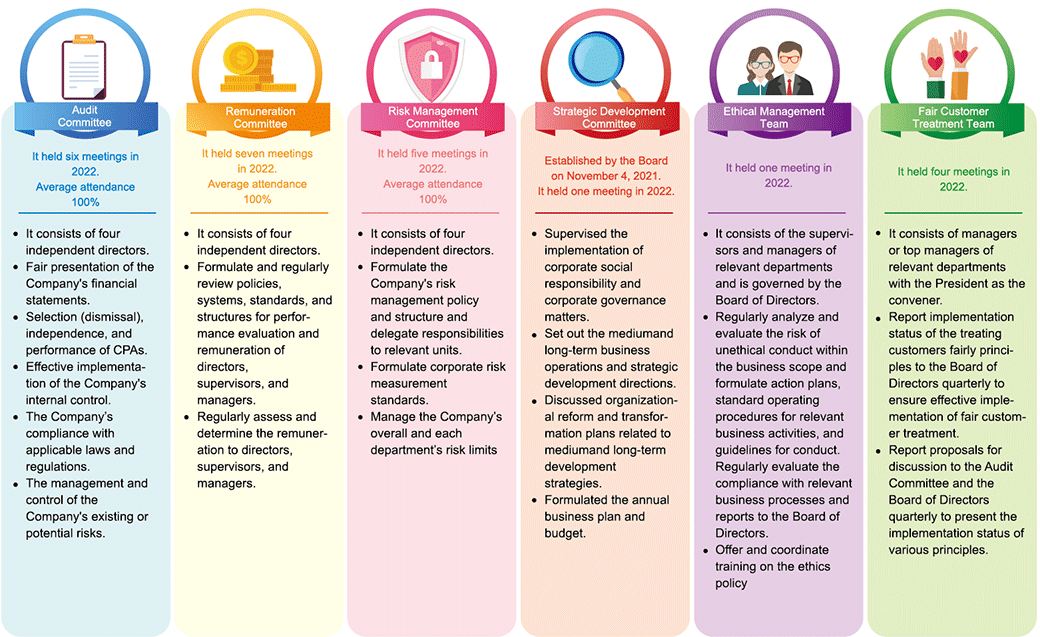

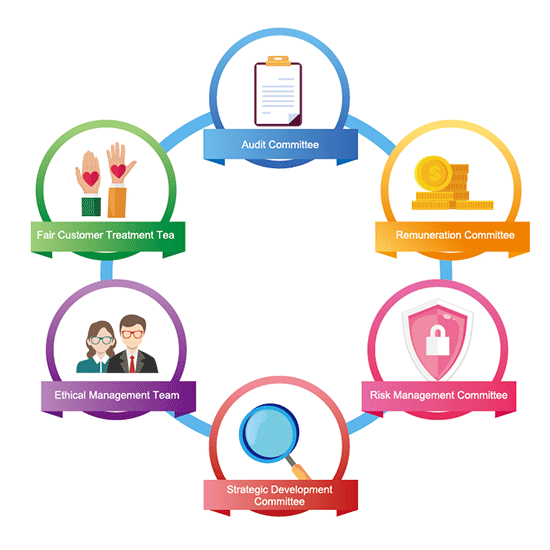

The Operations of Functional Committees and Teams

To reinforce the supervisory function of the Board of Directors, we have established an Audit Committee, the Remuneration Committee, the Risk Management Committee and the Strategic Development Committee under the Board of Directors; each of these four functional committees are formed by directors and independent directors. There are also the Ethical Management Team and the Fair Customer Treatment Team in place and they report to the Board of Directors regularly

2.1.3 Members of the Board of Directors

Selection Process for Members of the Board and Functional Committees

The election of PSC directors is carried out in accordance with Article 192-1 of the Company Act and Article 13 of PSC's Articles of Incorporation, which adopts a candidate nomination system. Candidates for directors can be nominated by shareholders holding 1% of the total issued shares or by the Board of Directors. Independent directors and non-independent directors are elected in the same election, with their quotas calculated respectively. The Company will announce the acceptance period for nominations of director candidates from shareholders holding more than 1% of the shares, the number of directors to be elected, the place of nomination acceptance, and other necessary matters before the record date for the shareholders’ meeting. Additionally, the Company conducts an annual board performance evaluation, and the results serve as a reference for the selection or nomination of directors.

As for PSC’s functional committees, the Audit Committee, Remuneration Committee, and Risk Management Committee consist of all independent directors and are appointed by the Board of Directors. The Strategic Development Committee is chaired by the Chairman of the Board, with other members nominated by the Chairman, including at least one independent director. The number of directors (including independent directors) should be more than half, and they are appointed by the Board of Directors. The current (first term) Strategic Development Committee consists of the Chairman of the Board, four independent directors, two directors, the President, and the Executive Vice President, totaling nine members.

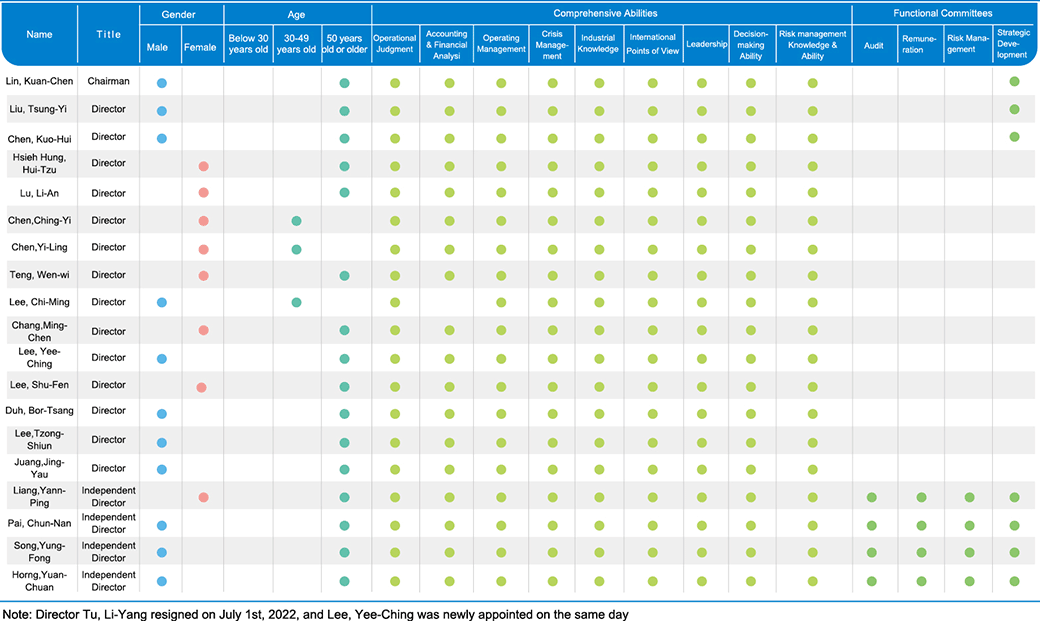

Diversity in the Board of Directors

The board structure, in accordance with the Corporate Governance Best Practice Principles for TWSE/ TPEx Listed Companies, is based on the diversity principle. Considering the Company's business development needs and shareholders' shareholdings, and practical needs in operations, we have elected directors with professional knowledge, skills, competencies, and extensive industry experience. The board as a whole should possess the capabilities below:

PSC has a diversity policy as stipulated in Article 10 of the Corporate Governance Best Practice Principles: “Diversity, a reasonable combination of expertise, and objective criteria for the independent exercise of authority should be carefully considered in the selection of directors. The overall composition should possess diverse abilities, including operational judgment, accounting and financial analysis, business management, and crisis handling.”

Our independence policy is based on Article 26-3, paragraphs 3 and 4 of the Company Act. The members of PSC’s Board of Directors have no spousal or relative relationships within second degree of kinship among them. Additionally, we have four independent directors who provide objective opinions on matters concerning their area of expertise, promoting the self-supervision function of the board.

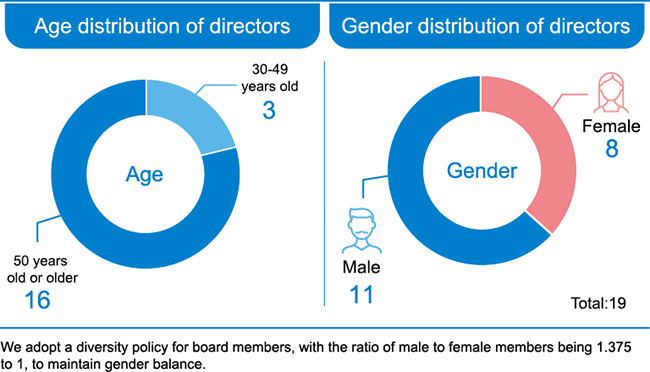

We currently have 19 directors in place, including four independent directors and 15 non-independent directors. They have diverse professional backgrounds in financial management, corporate management, economics, investment, international trade, and law. They also have experience spanning various industries, including securities and futures, investment trust and advisory services, investment development, optoelectronics, technology, telecommunications, steel, and others. PSC also places great emphasis on the gender composition of the board members, with a target of having a female director representation of over 30% each year. In 2022, there were eight female directors, accounting for 42% of the board members.

We adopt a diversity policy for board members, with the ratio of male to female members being 1.375 to 1, to maintain gender balance.

Directors’ Continuing Education

In 2022, our directors and independent directors participated in internal and external training courses on corporate governance for a total of 158 hours. Such courses covered topics of business decision-making, corporate management, money laundering prevention, future trends, corporate fraud investigation, and business transformation. To enhance the knowledge of the Company's directors and independent directors about economic, environmental, and social issues and the current corporate governance trends, we invite outside lecturers or experts to deliver at least two training sessions for directors annually. In recent years, the topics of such courses include the corporate governance and corporate social responsibility development trends, big data analysis and corporate fraud detection and prevention, fair treatment of consumers, the prospect of artificial intelligence, and sustainable finance. In 2022, we offered courses on “Insider Trading and Ethical Corporate Management Best Practice Principles for Corporate Governance” and “From AI to AI Plus: Embracing the Fintech Wave Head-On”and offered an online course on the Fair Trade Act to increase their awareness of the rule of law and ensure their compliance.

Directors’ Recusal Mechanism

As per the Rules of the Procedure for Board of Directors Meetings of President Securities Corporation, when a proposal at a board meeting involves personal interests of the directors or the juridical persons they represent, they should explain the important content of their interests at the board meeting. If that may undermine the Company’s interests, they should recuse themselves from discussion and voting and should not exercise their voting rights on behalf of other directors. To ensure proper prevention of conflicts of interest, directors have signed the Directors' Conflict of Interest Statement upon taking office. The Company’s Codes of Ethical Conduct for Directors and Managers also stipulate that directors and managers of the Company shall not use their positions in the Company to confer undue benefits on themselves, their spouses, parents, children, or relatives within second degree of kinship. In addition, the Company has appointed four independent directors, accounting for 21% of the total board seats. Independent directors have repeatedly raised questions and made suggestions based on their own experiences and perspectives during board meetings and various functional committees, thereby exercising their independent and objective supervisory functions.

Matters the Company should disclose regarding director independence include the relationships among board members, transactions with related parties, and instances of directors recusing themselves from conflicted matters. The Company's Board of Directors operated in compliance with the Rules of the Procedure for Board of Directors Meetings in 2022, with no instances of conflicts of interest. For information related to conflicts of interest disclosure, please refer to page 33 of the PSC 2022 Annual Report.

Board and Management Team Succession Plan

There are 19 directors including four independent directors in office, and independent directors account for 21% of all directors. They possess expertise in finance, business, law, and industry. The percentage of independent directors has met the legal requirement; all independent directors have not served for more than three consecutive terms in compliance with the legal requirement.

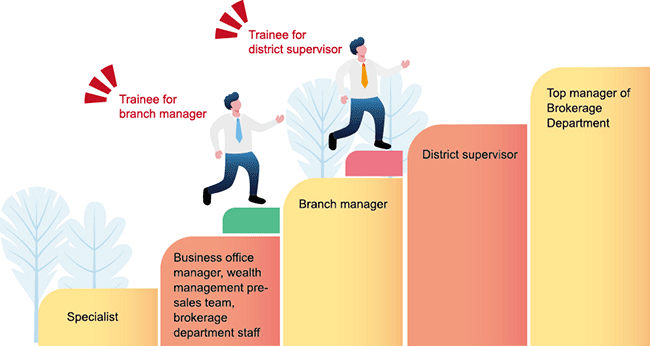

To meet the needs of the organization's business development and take on operational challenges, we have launched a management trainee program for the Brokerage Department, to effectively pass on experience and skills and train senior management trainees through a systematic selection and training mechanism. We selected potential talents with outstanding performance and sales skills for this program. We cultivated their strategic thinking, team management, customer management, problem analysis and solving skills and abilities in "learning by doing" methods, including apprenticeships, job rotation, and mentor coaching.

In March 2022, we promoted one trainee who had just completed the first phase of the branch manager training to branch manager. In the future, we will continue to implement the trainee program for branch managers and business office managers to ensure a talent pool for business management.

2.1.4 Functional Operation and Communication of the Board of Directors

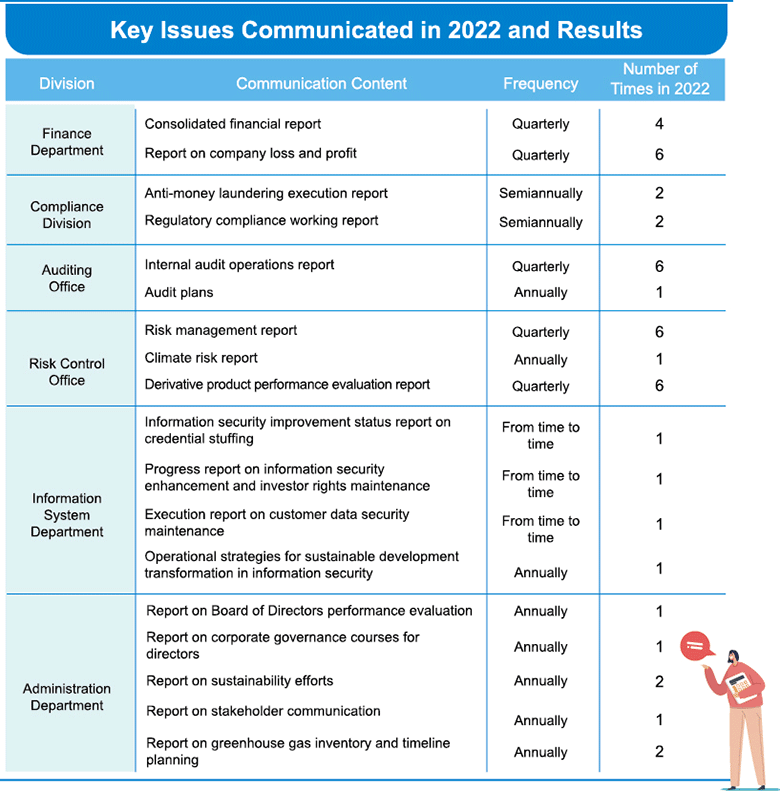

In addition to the oversight provided by the four functional committees, the Ethical Management Team, and the Fair Customer Treatment Team to monitor the progress of various internal operations, each business unit also directly communicates with the Board of Directors to report on the progress, achievements, and performance of their respective responsibilities. This facilitates direct feedback and guidance from the Board of Directors, ensuring the implementation of corporate governance and the board's supervisory role in organizational operations

Shareholders' Equity

As per the Rules of Procedure for Shareholders' Meetings of President Securities Corporation, shareholders holding 1% or more of the total issued shares may submit a written proposal for the Company’s annual general meeting of shareholders, and shareholders may exercise their voting rights in writing or by electronic means. PSC held an annual general meeting of shareholders on June 23, 2022. As per the Company's Articles of Incorporation, we, at the shareholders’ meeting, put forth the reports resolved by the Board of Directors, proposals, matters to be discussed, and an election proposal to shareholders, including a report on the operations in 2021, the Audit Committee's review report on the 2021 financial statements, the 2021 employee remuneration and directors’ remuneration distribution proposal, the 2021 business report and consolidated and standalone financial statements, the 2021 earnings distribution statement, a proposal for amendments to the Company's Articles of Incorporation, a proposal for amendments to the Rules and Procedure of Shareholders’ Meetings, and a proposal for amendments to the Handling Procedure for the Acquisition or Disposal of Assets in response to the official letter issued by the competent authority. This enables the Company's shareholders to understand the Company's operational status and provide feedback based on its performance.

2.1.5 Board Performance Evaluation and Remuneration Policy

Board Performance Evaluation

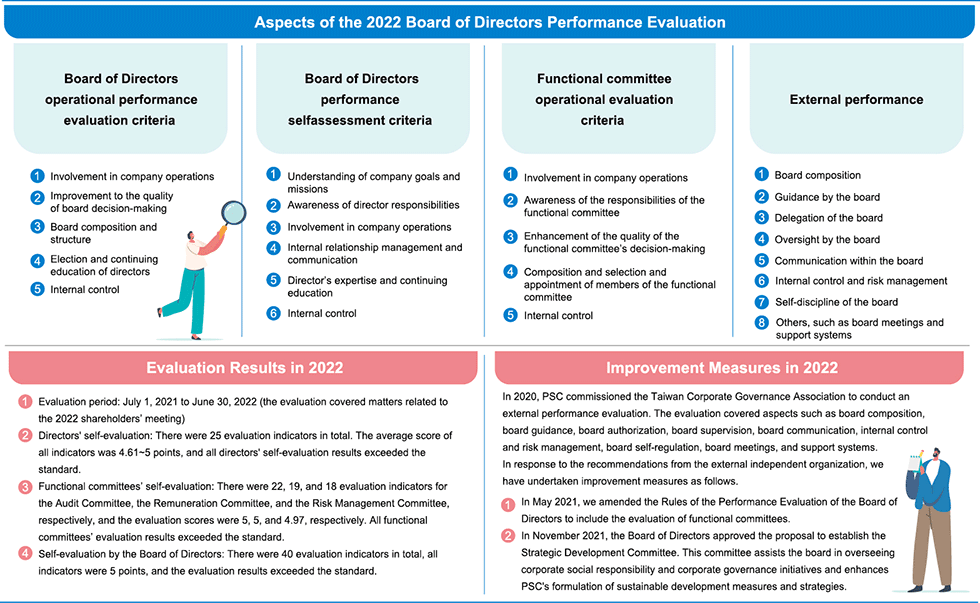

To implement corporate governance, enhance the functions of the Company and the Board of Directors, and set performance targets to enhance the operational efficiency of the Board of Directors, PSC passed the formulation of the Rules of the Performance Evaluation of the Board of Directors of President Securities Corporation in accordance with the operational environment and external regulations at the 2nd board meeting by the 11th Board of Directors on August 29, 2018 and continues to optimize and amend the rules. The date of the latest amendment was May 6, 2021. We evaluate the performance of the Board of Directors on our own once a year, and the results of the performance evaluation should be completed before the end of the first quarter of the following year. The results will be disclosed in the annual report or on the Company's website or the MOPS. We refer to individual directors’ performance evaluation results when electing directors or nominating candidates for independent directors

In accordance with the Rules of the Performance Evaluation of the Board of Directors, we appoint an outside professional independent organization or an external team of experts and scholars to evaluate the board performance at least once every three years. In 2020, we appointed the outside professional organization, Taiwan Corporate Governance Association, to evaluate the board performance. The board performance evaluation results were submitted to the 16th meeting of the 11th Board of Directors on November 10, 2020 for review, and the results were disclosed in the annual report and the Company's website. The next external performance evaluation is scheduled in 2023.

As per Taiwan Corporate Governance Association’s evaluation suggestions, the Company submitted a proposal to the Board of Directors in May 2021 to amend the Rules of the Performance Evaluation of the Board of Directors and include the functional committees in the performance evaluation scope. We included the self-evaluation of functional committees in the board performance evaluation carried out in 2021.

The performance evaluation of the Board of Directors for the year 2022 was conducted through self-assessment. The evaluation results were reported at the 8th board meeting by the 12th Board of Directors in November 2022.

Directors and Senior Managers Remuneration

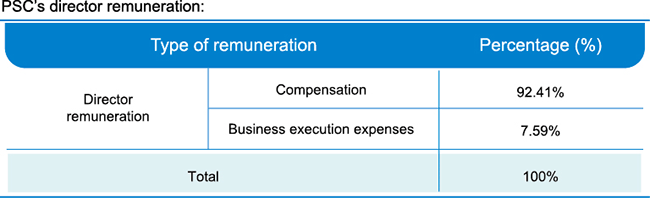

As per Article 23 of the Articles of Incorporation of PSC, the Company may allocate no more than 2% of the year’s profit as remuneration to directors and may provide reasonable compensation to directors based on the Company's operating performance and their contribution to the Company's performance.

PSC’s director remuneration:

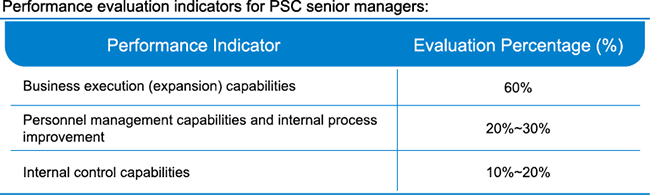

The remuneration to the President and the Vice President s is determined based on the Company's remuneration policy, the salary level of such positions in the industry, the scope of responsibilities of such positions in the Company, and the contribution to the Company's operating goals. We determine and provide reasonable remuneration based on such individuals’ contribution to our business performance in accordance with the performance evaluation regulations. The relevant performance and the reasonable remuneration are reviewed by the Remuneration Committee and the Board of Directors, and the actual operating conditions are reviewed at any time. In addition, we review the remuneration system at any time as per the actual operations and applicable laws and regulations, thereby striking a balance between the Company's sustainable development and risk control.

Performance evaluation indicators for PSC senior managers:

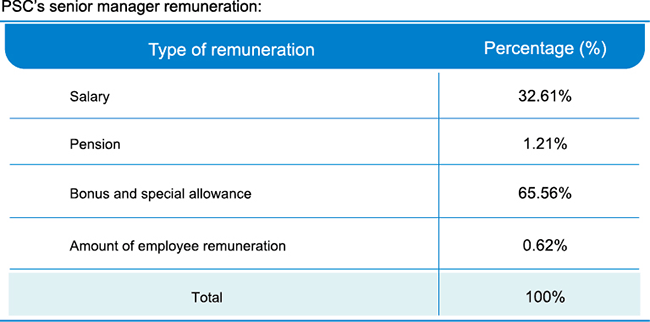

PSC’s senior manager remuneration:

PSC requires its directors and senior managers to sign to commit to the Company's Codes of Ethical Conduct for Directors and Managers. The codes outline the responsibilities of directors and senior managers, including the duty to avoid conflicts of interest, maintain confidentiality, engage in fair transactions, and comply with legal and ethical standards. The Company encourages any employee who discovers or suspects violations of laws, regulations, or ethical standards within the organization to report such incidents in accordance with the Company's whistleblowing policy. In cases where directors and managers violate the codes, the Company will take appropriate actions in accordance with pertinent regulations and promptly disclose information about the violations, including the date of the violation, the nature of the violation, the applicable standards, and the actions taken, on the Market Observation Post System. Individuals subject to penalties for violating the Codes of Ethical Conduct for Directors and Managers have the right to appeal according to relevant regulations.

Furthermore, senior managers are employees of the Company. If they violate the Company’s Codes of Ethical Conduct for Directors and Managers and the Rewards and Penalties Regulations, other legal requirements, or engage in actions that harm the Company's reputation or public order and morals, they may face penalties, including a reduction in rewards or temporary suspension of duties, based on the severity of the violation. In cases of serious misconduct, the Company reserves the right to terminate their employment.