Operational Vision

2.3 Regulatory Compliance

2.3.1 Organizational Structure and Policies of Regulatory Compliance

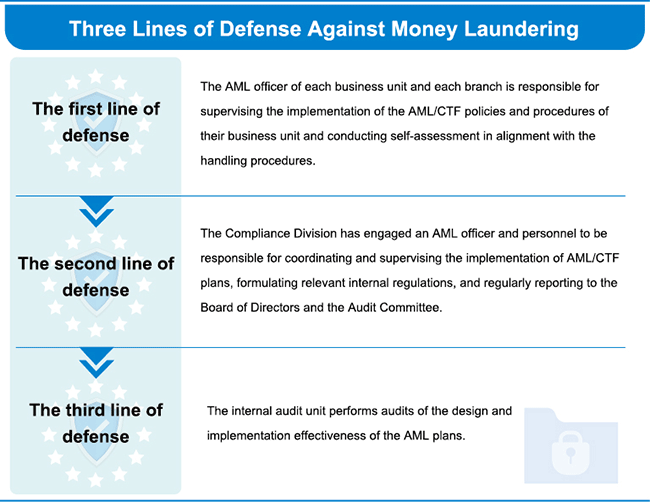

We have set up the Compliance Division, consisting of one compliance officer and three compliance personnel to implement the laws and regulations on compliance and AML/CTF as required by competent authorities. In addition, each business unit and branch of the Company has engaged an AML officer to rigorously monitor and prevent money laundering activities. The Compliance Division provides employees with channels for inquiring about laws and regulations, updates the compliance information on the website, and provides the latest legal information to enhance their awareness of laws and regulations.

We conduct legality assessments for new business, new financial products, or important business activities, to ensure that the relevant business activities and new products are in compliance with laws and regulations. All business activities and publicity documents should be reviewed internally and in compliance with regulations, and relevant units review their legality to protect consumers’ rights and maintain the Company's reputation and image.

The Company has properly allocated regulatory compliance and anti-money laundering personnel and developed organizational standards for anti-money laundering and combating the financing of terrorism (AML/CFT) procedures. We also conduct regular reviews of our compliance practices and promptly update them based on recommendations from competent authorities after audit. This ensures that the Company's internal regulations are fully aligned with various legal requirements and AML/CFT regulations.

Insider Trading Control

To prevent insider trading, we have formulated the Internal Material Information Processing Procedure and the Board of Directors adopted the amended version in March 2020. The content includes division of responsibilities, confidentiality, firewall operations, material information disclosures, and education and training, to strictly control insider trading. In addition to employees, we require other important inside and outside personnel to sign confidentiality agreements, to keep confidential various confidential documents processed and transmitted depending on the importance. We also adopt a spokesperson, who is responsible for releasing material information to the outside world.

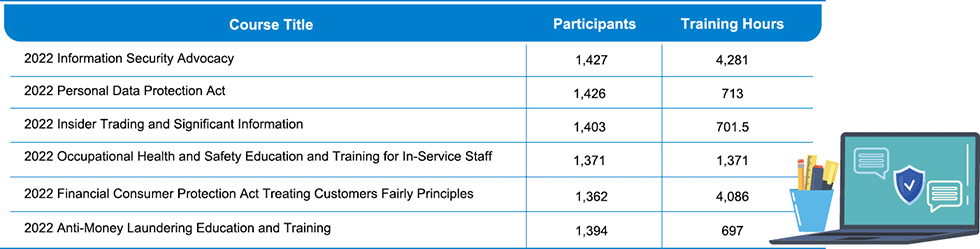

Furthermore, we comply with competent authorities’ regulations and included insider trading in 44 suspected money laundering patterns for control. In the event of suspected money laundering, the Compliance Division will report it to the Investigation Bureau in a confidential manner for monitoring purposes. We arrange for all employees to receive education and training on insider trading prevention and AML every year to raise their awareness of laws and regulations and remind them of matters to be noted during practical operations.

Internal Promotion of Regulatory Compliance

We adopt awareness-raising events and education to increase the awareness of the concept of the rule of law, to achieve the purpose of compliance with laws and regulations. Furthermore, the Compliance Division raises participants’ awareness of compliance during the practical operations and shares cases at the Company's regular business managers meetings in Taiwan, financial and banking managers meetings, and audit meetings.

The Company's AML personnel have all obtained the domestic AML license, and three of them have obtained the Certified Anti-Money Laundering Specialist (CAMS) certificate. AML personnel regularly receive refresher training at the competent authority or pertinent institutions for 12 hours every year or participate in training or seminars organized by various training institutions from time to time. The above training covers AML regulations, implementation practices, and punishment cases.

2.3.2 Regulatory Compliance Status

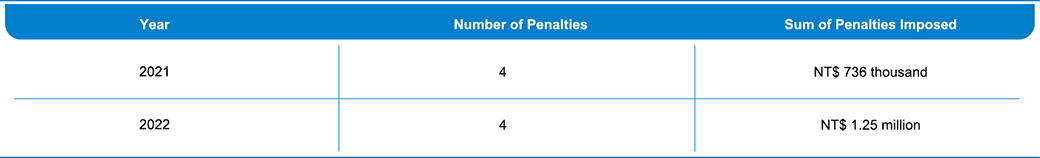

PSC makes every effort to comply with regulatory policies and audit processes of the competent authority. The total number of penalty cases and the total amount of penalties imposed on PSC in the past two years are as follows.

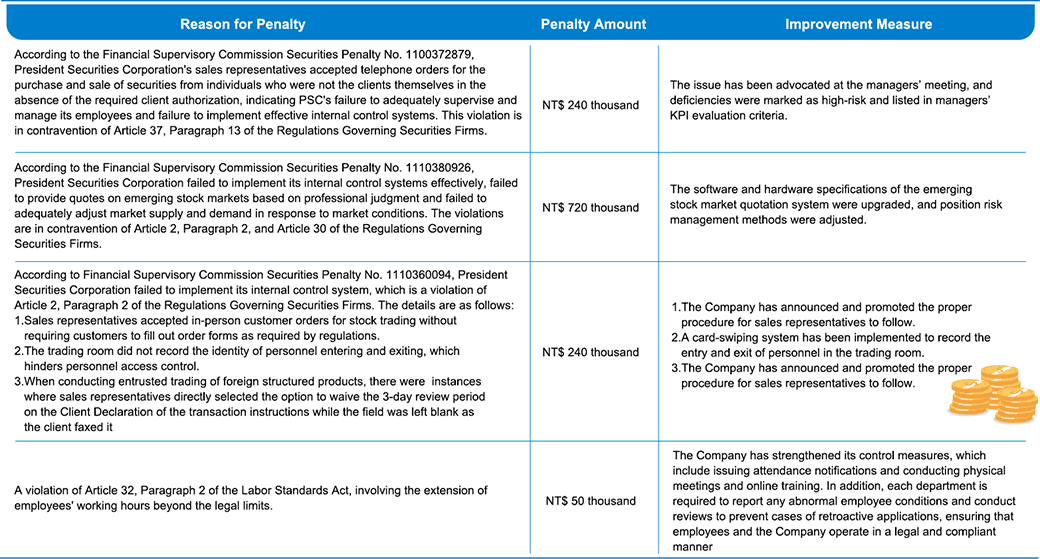

Details of the reasons for the penalties imposed by the competent authority, penalty amounts, and improvement measures taken in 2022 are as follows

According to the Financial Supervisory Commission's Explanation of the Procedure for Announcing Major Penalties for Violations of Financial Laws and Regulations, major penalty cases refer to cases where financial institutions are fined more than NT$ 3 million. In 2022, the Company did not experience any cases where it was subject to major penalties imposed by the competent authority (including fines and nonmonetary sanctions). There were also no incidents related to anti-competitive behavior, antitrust violations, or monopolistic practices during the same period. Details of any regulatory penalties incurred by the Company and internal personnel in 2022, as well as the related improvement action plans, can be found on pages 59 to 61 of PSC’s annual report.

2.3.3 Whistleblowing System and Procedures

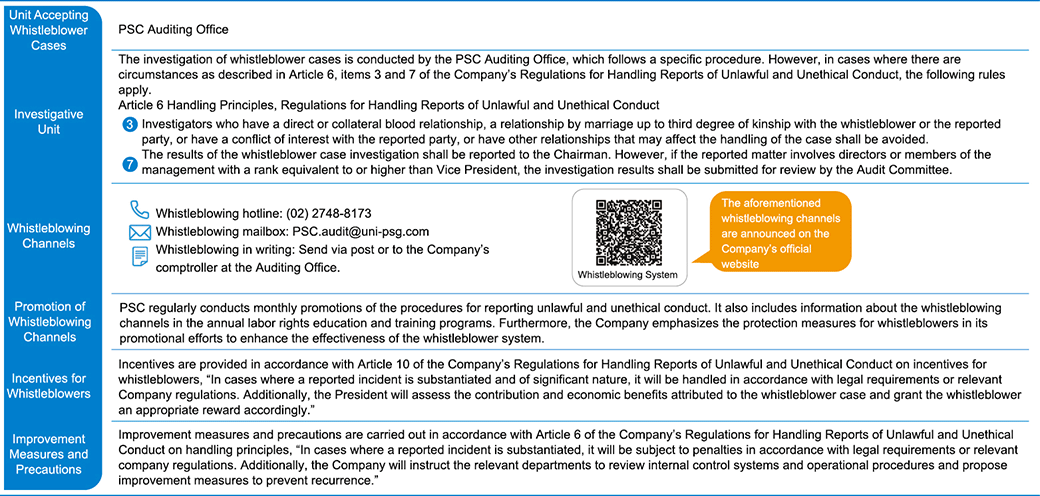

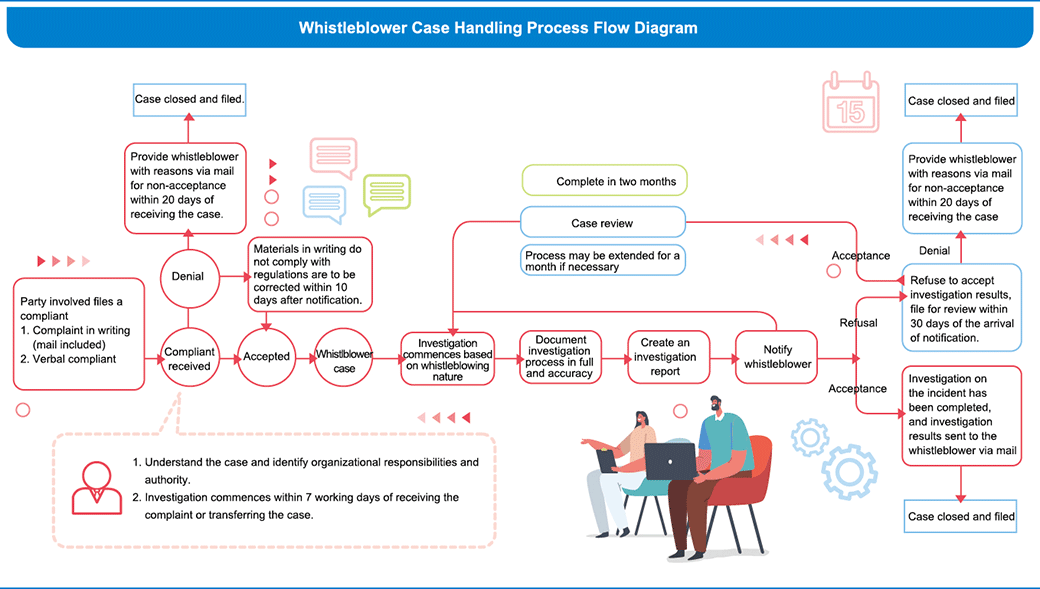

In accordance with PSC's Regulations for Handling Reports of Unlawful and Unethical Conduct, anyone who becomes aware of any actions by the Company's employees that violate legal regulations, the Company's Ethical Corporate Management Best Practice Principles, Work Rules, or any other ethical standards can report such unlawful or unethical behavior to the Company through the designated whistleblowing hotline, email address, or in writing. To encourage reporting of such behavior, the Company may offer appropriate rewards for cases where the reported incidents are substantiated and of significant nature. We will also ensure that reports and related information are handled with strict confidentiality and care to safeguard whistleblower identity and the content of the report.

As of 2022, PSC has received a total of 2 whistleblower cases. According to the investigation results, one case involved an employee who violated legal regulations, and the competent authority imposed a 10-month suspension of business operations as a penalty. In the other case, an employee did not comply with the internal guidelines for employee expense reimbursement, and disciplinary actions have been taken, as well as enhanced education and training in response to this case.