Low Carbon Transition

5.1 Climate Change Management

By harnessing the power of its financial institution, PSC effectively channels funds into addressing climate issues to leverage the financial sector's influence and connect industry supply chains. This strengthens the climate resilience of both the financial industry and other sectors and promotes investments in carbon reduction and sustainable development. Following the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), PSC outlines methods for identifying and assessing climate change risks throughout its operations. The Company also implements management measures to enhance the climate resilience of its value chain.

In June 2023, PSC published its first Climate Change Financial Disclosure Report on its website, demonstrating its commitment to addressing climate change management issues. The following is a summary of the content of the Climate Change Financial Disclosure Report. For detailed information, please refer to the full report.

5.1.1 Climate Governance Structure and Responsibilities

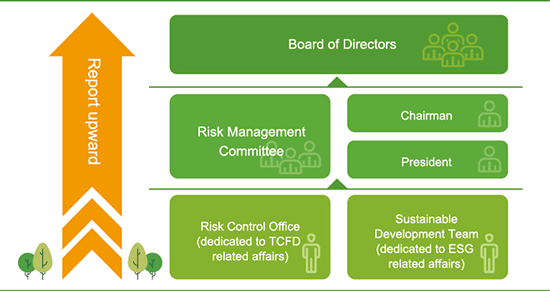

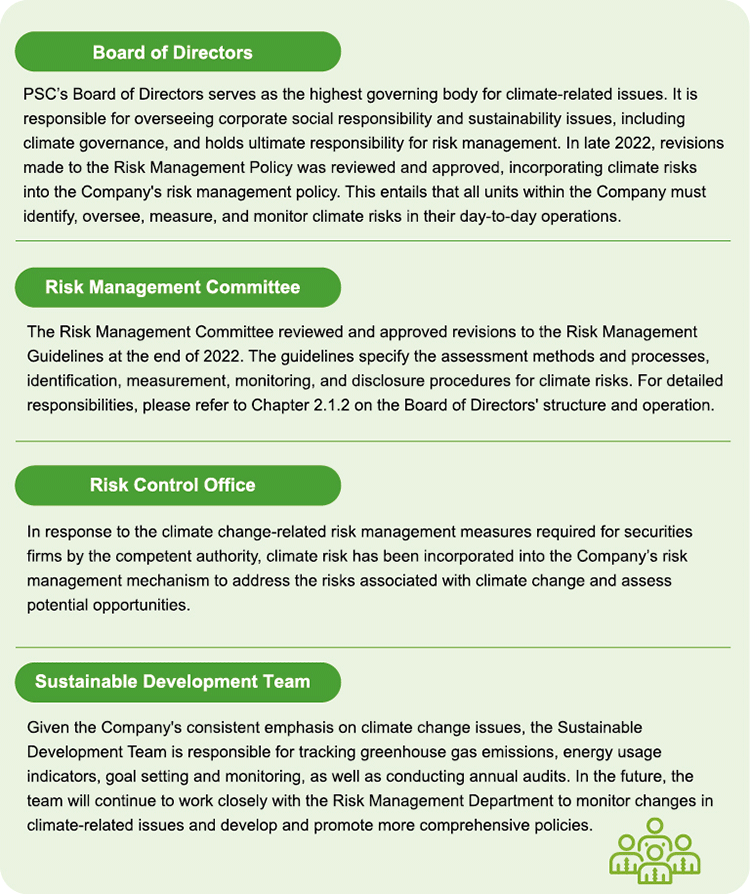

PSC adopts a rigorous and thorough approach to risk management, and it is particularly proactive and supportive of climate risk issues. The climate change governance framework involves the Board of Directors, Risk Management Committee, TCFD Task Force, and the Sustainable Development Team, each with its respective roles. This ensures that all employees recognize the importance of climate change and work together to address the climate-related issues PSC is faced with.

5.1.2 Climate Risk Management

1. Incorporating Climate Risk and Reputational Risk into PSC Risk Management Structure

The risk scope of securities firms encompasses operational risk, regulatory compliance risk, and environmental risk. This year, climate risk has been incorporated into the PSC’s risk management policies and guidelines, and processes for measurement and assessment have been established to highlight the Company’s commitment to evaluating and managing the impact of climate change on the overall business environment with a prudent approach. Furthermore, a three-line defense framework of internal control is deployed to manage the various risks the Company faces in its operations, including emerging climate-related physical and transition risks. Each line of defense has its respective responsibilities, and for further details regarding their roles, please refer to Chapter 2.4.1 on risk management policies and organization structure.

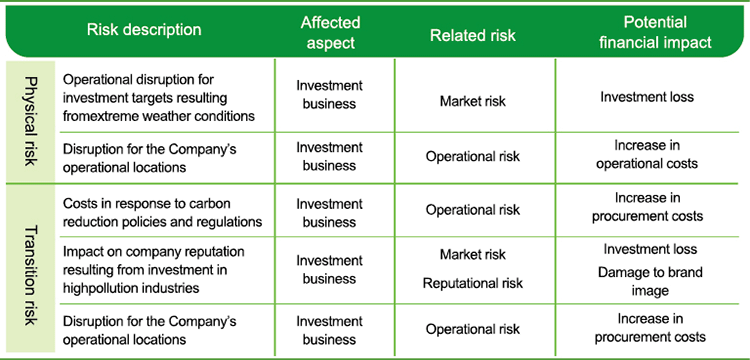

2. Risk Identification and Linking It with Existing Risks

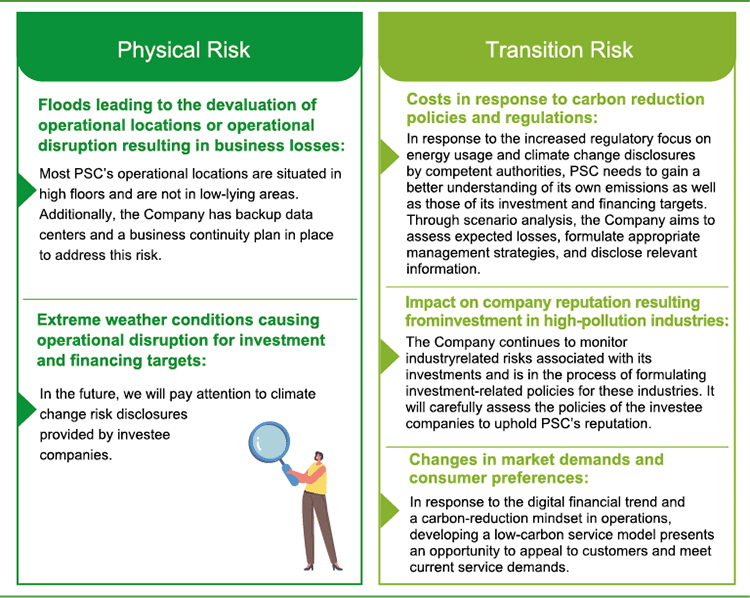

In the wake of changes in climate and the overall market transitioning towards a low-carbon future, varying degrees of impact will be felt at different times, subsequently affecting existing risks such as reputational risk, market risk, and operational risk. Through PSC’s climate risk identification process, the potential financial impact on the Company is assessed based on the types of physical and transition risks, allowing for integration and management within the current risk management framework.

3. Climate Risk Response

In response to climate risks, PSC continues to convene various units to formulate strategies aimed at mitigating the operational and financial impacts of climate change on the Company. Concrete actions are taken to adapt to the extent of the impact. Based on the Company's business, strategies, and financial planning, climate-related risks are identified and assessed. The assessment includes evaluating the impact and occurrence of risks, as well as their impact levels on the Company's reputation, business, and finances. The existing measures and their effectiveness are examined as well to propose feasible solutions in the future.

4. Climate Risk Identification by Industry

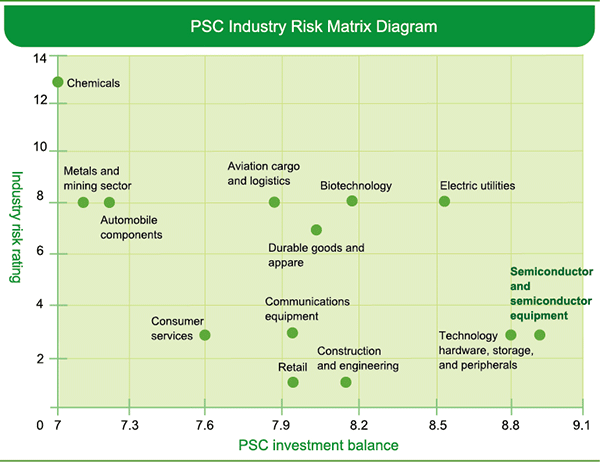

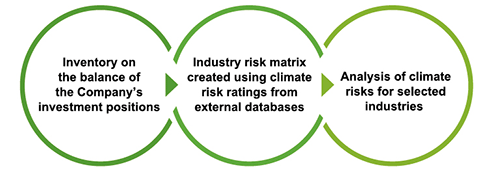

In the current fiscal year, PSC's Risk Control Office collaborated with external consultants to consolidate information on the Company's investment balances and industry sectors. They have also referred to domestic and international industry-specific risk reports and trends in the financial market. Through data collection from various databases, the carbon emissions of investee companies were assessed to measure the transition risks PSC is faced with. According to the analysis results, the semiconductor and semiconductor equipment industries are among the high climate risk sectors in the Company's investment portfolio.

5. Transition Risk Quantitative Scenario Analysis

① Industry Climate Risk Identification

To understand the climate-related risks we face and further assess their potential impacts, PSC collects and compiles sustainability reports from benchmark companies in the semiconductor and semiconductor equipment industry, as well as climate risk research reports. Industry characteristics, the occurrence likelihood of climate risks, their impact potential, and the availability of analysis information are considered. From the climate risk list in the semiconductor and semiconductor equipment industry, we have identified climate risks that have a significant impact on our investment positions for subsequent quantitative analysis.

② Scenario Analysis

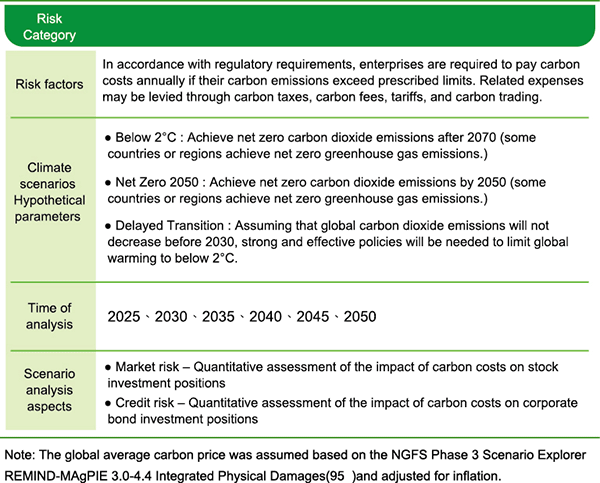

Given that various countries are gradually implementing carbon pricing mechanisms to achieve global warming mitigation goals, enterprises will face additional compliance costs. PSC has chosen to conduct scenario analysis on carbon cost transition risks to further assess these impacts.

a. Transitional climate risk and climate scenarios

In light of the increasingly stringent carbon emissions regulations, the Company has conducted scenario analysis through a systematic assessment process to understand the potential financial impact of additional compliance costs incurred by investee companies on PSC's investment positions. Climate scenarios are coordinated in the analysis to simulate the potential financial losses under various climate scenarios, including Below 2°C, Net Zero 2050, and Delayed Transition. This information will serve as a criterion for evaluating future investment portfolios and further aid in the development of strategies and measures to enhance the Company's climate risk management.

Taking into account the climate sensitivity of the industry and the scale of risk exposure, the focus is placed on specific industries, including Biotechnology and Healthcare and Technology Hardware, Storage and Peripherals, which will be included in the analysis of transitional climate risks to enhance the climate resilience of investment positions.

b. Transition risk scenario analysis: Impact of carbon costs on stock and corporate bond investment positions

Assessment significance

In response to regulatory carbon cost requirements, the additional compliance costs for companies in the stock investment portfolio may increase, indirectly affecting their net asset value and causing stock price depreciation. For companies in the bond investment portfolio, if their transition risks and additional costs are significant, it may indirectly lead to changes in sustainability ratings by international rating agencies, thereby increasing credit risk and expected losses. The Company will regularly review and analyze the expected losses of its corporate bond investment positions to assess the impact of climate risks.

Assessment target

Issuing companies of domestic and foreign stocks and corporate bonds of high-climate-risk industries in the Company’s investment portfolio.

Assessment methodology

For stock investment positions, the impact on corporate net worth is calculated by estimating the additional carbon cost for each target company. This calculation analyzes changes in relative stock prices and depreciation losses and presents them along with the impact ratio for that industry. In terms of corporate bond investment positions, the assessment focuses on target companies’ own carbon cost transition risk, estimates the additional compliance costs of carbon costs for each target company in the investment position and analyzes the potential impact of carbon cost transition risk on corporate bond positions.

c. Assessment result and countermeasures

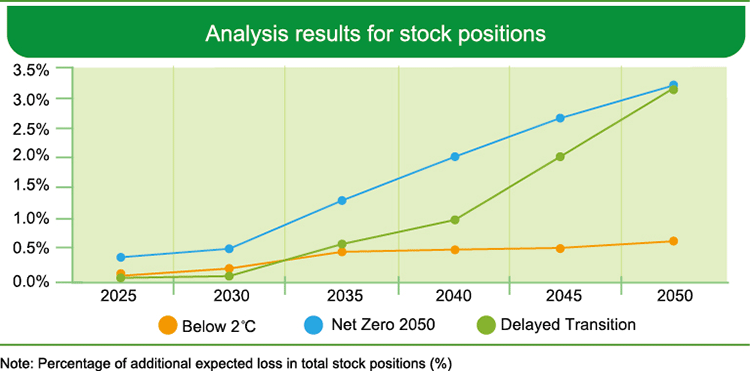

Stock investment positions

According to the analysis results, the impact levels for each industry in various climate scenario analyses are projected to increase over the years. Among them, the impact of the Net Zero 2050 scenario is particularly significant. Based on the policy assumptions of the Delayed Transition scenario, the simulated additional carbon-related compliance costs are expected to increase starting in 2030, and their impact level will be higher than that of the Below 2°C scenario. Under the Net Zero 2050 scenario, the total additional expected losses for PSC's stock investment positions in 2050 are approximately NT$ 29 million, accounting for approximately 3.2% of total stock positions.

Through comprehensive assessment, it has been determined that carbon-related policies and regulations under various climate scenario simulations do not have a significant impact on PSC’s stock investment positions. In the future, the Company will continue to set impact thresholds for assessing the severity of climate risks. In addition, it will delve deeper into understanding the impact pathways of climate risk and their potential effects on assets. The Company will also focus on the ESG indicators and climate adaptation actions of its investment targets to enhance the climate resilience of its stock investment positions.

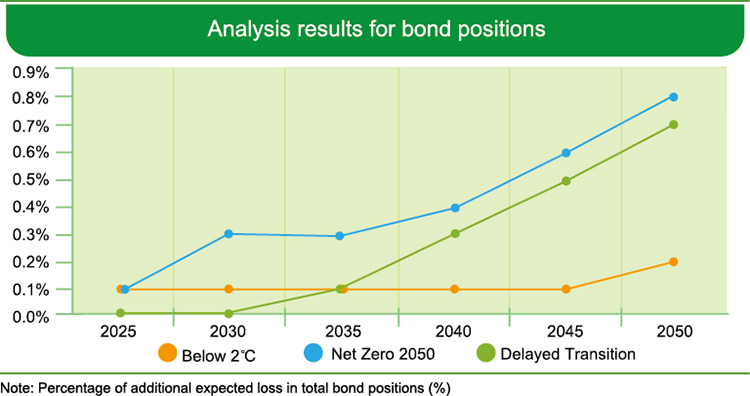

Corporate bond investment positions

According to the analysis results, as PSC only holds convertible corporate bond positions in the biotechnology and healthcare industry, there will be no expected losses after 2030 due to bond maturity. However, the corporate bond positions will continue to have an impact on the Company's investment positions from 2030 to 2050. According to the policy assumptions under the Delayed Transition scenario, the additional carbon compliance costs are projected to increase starting in 2030, leading to an increasing impact on the positions. Under the Net Zero 2050 scenario assumption, the additional expected losses for PSC’s corporate bond investment positions in 2050 are approximately NT$ 4.9 million, accounting for approximately 0.8% of total bond positions.

In summary, carbon-related policy regulations are not expected to pose significant risks to PSC’s corporate bond investment positions under various climate scenario simulations. In the future, the Company will continue to enhance risk management, set impact severity thresholds, and focus on the ESG indicators and climate adaptation actions of investment targets to reduce the impact of climate change on the Company's corporate bond investment positions.

6. Physical Assessment and Response

In the face of extreme weather events such as typhoons and flooding, there are physical risks that could disrupt the Company's operations, including its data centers and office buildings. After assessment, it was determined that except for the Pingzhen branch office, which is located on the ground floor, all other operational sites are situated on the second floor or higher. This lowers the overall likelihood of these operational sites being affected by flooding. Additionally, PSC’s information data center, despite being located in the Taipei Basin, given the government's continuous efforts to enhance drainage systems to cope with extreme rainfall, should benefit from improvements in flooding situations. Furthermore, PSC has established backup data centers in remote locations to ensure undisrupted operations in case the primary data center is rendered inoperable due to any impact. An operational continuity plan is in place to address emergency procedures in the event of natural disasters and the Company conducts drills in accordance with TWSE’s semi-annual backup exercise plan to reduce service disruptions caused by disasters to an acceptable level.

5.1.3 Climate Strategies

1. Identification of Climate Opportunities

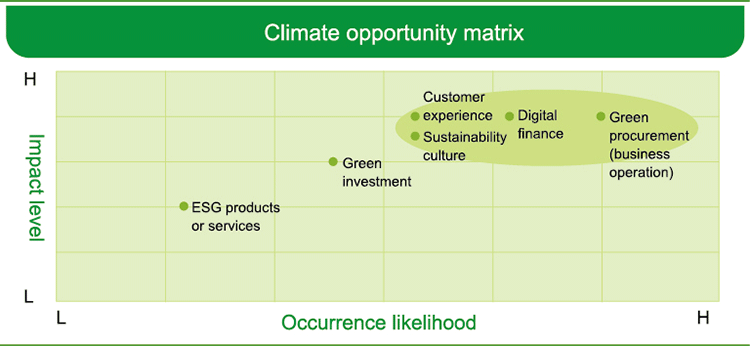

PSC actively seeks climate transition opportunities through surveys and cross-departmental integration meetings. References include the collection and assessment of opportunities and occurrence likelihood conducted by each department and policies they formulate accordingly. After analysis and discussions across various departments, PSC has identified projects with a high likelihood of positive impact and occurrence due to climate change. These projects include green procurement and operations, digital finance, and sustainability culture. In the future, each department within PSC will continue to monitor climate change issues and changes in the financial markets so as to stay informed about relevant topics related to climate change and develop strategies to capitalize on business opportunities.。

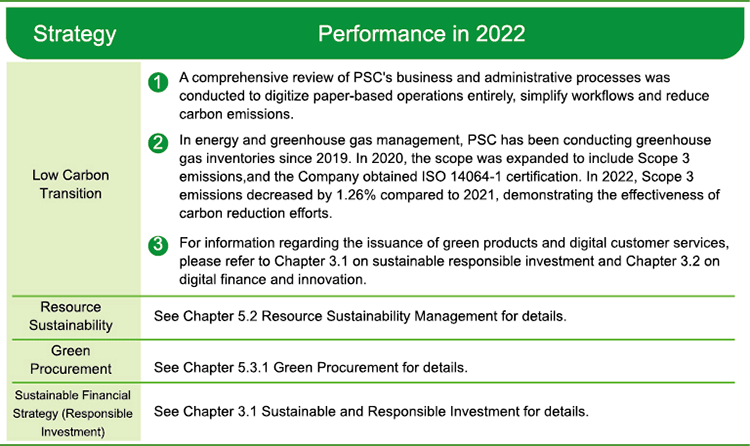

2. Vision of Environmental Sustainability

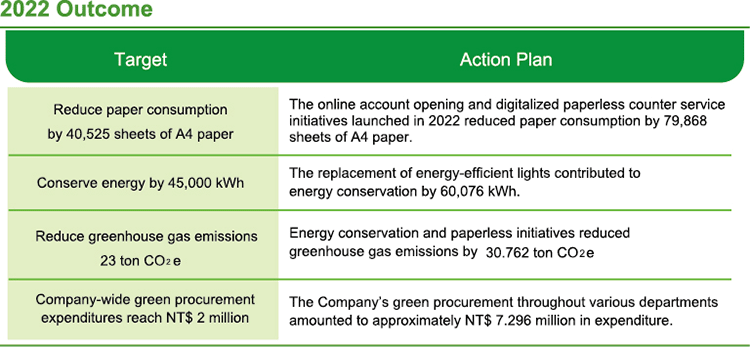

PSC is committed to environmental sustainability in four key areas: Low Carbon Transformation, Resource Sustainability Management, Green Procurement, and Sustainable Financial Strategy. The Company has established the Eco-Friendly LOHAS Network on its intranet to share new knowledge and environmental awareness with PSC employees, ensuring that every member of PSC can contribute to a more sustainable future by integrating sustainability into their daily lives.

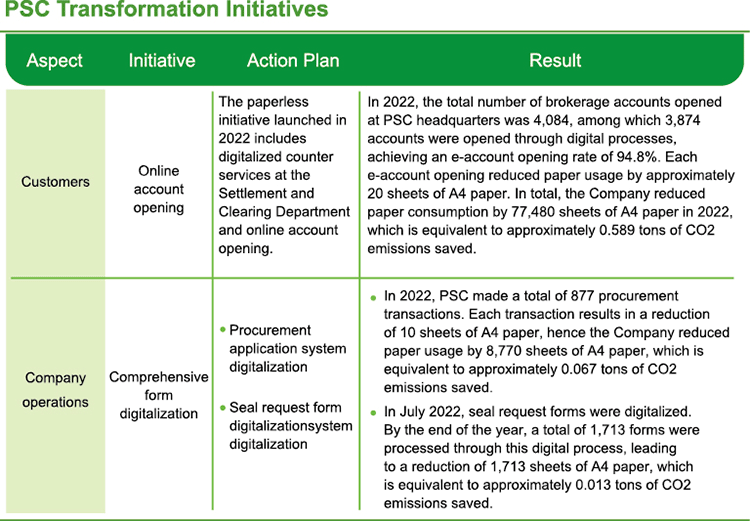

Low Carbon Transformation Strategy (Green Operation)

PSC’s low-carbon transition policy regarding customers is currently focused on the development of digital financial services. The services include enabling customers to, after they open their accounts, electronically sign various agreements and risk disclosure documents required by regulatory authorities, conduct various types of transactions directly on their mobile devices, and access online transaction reports in the comfort of their homes. In the future, the Company plans to gradually expand the scope and types of sustainable finance services, moving towards developing products with sustainable prospects or environmental benefits. In terms of company operations, PSC conducts a comprehensive review of business processes to digitize administrative forms, purchase certified environmentally-friendly products, and systematically replace old and energy-consuming equipment. These measures aim to reduce energy consumption, streamline energy cost expenditures, enhance operational efficiency, and reduce carbon footprints. Additionally, the Company has engaged external consultants to implement and complete greenhouse gas inventories according to ISO 14064-1 standards. Furthermore, we are attentive to issues that have an impact on resource efficiency, waste management, and climate change in our operations. In 2021, the Company adopted the ISO 14001 environmental management system and obtained verification subsequently in 2022.

❶ Greenhouse gas management

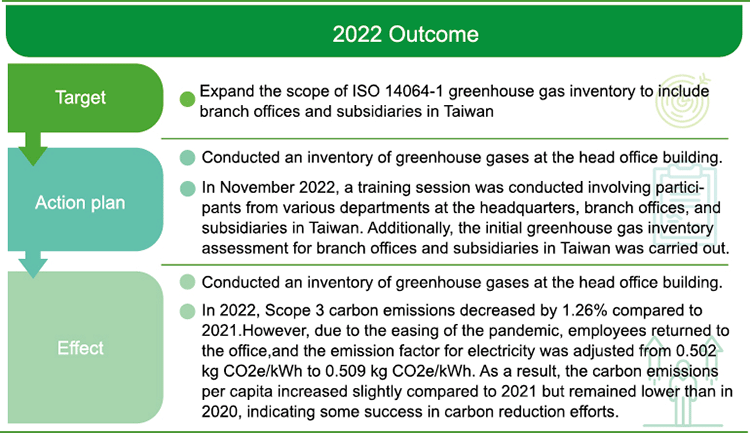

Our main greenhouse gas emissions come from purchased electricity, gasoline used by company vehicles, and diesel used by emergency generators. We adopted the ISO 14064-1 Greenhouse Gas Inventory in 2019 and have been covering scope 2 and scope 3 emissions (employee business trip and business travel) since 2021. The scope of verification covers the head office building (except for the areas leased to external suppliers). The coverage is 45.6% as per the number of people in the entire company. To effectively manage and set carbon reduction goals, we expanded the scope of inventory to cover branch offices and subsidiaries in Taiwan in 2022 and will continue to expand the coverage of the inventory

❷ Energy management

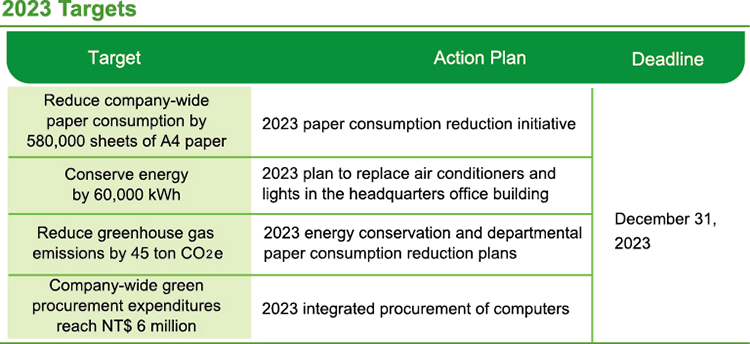

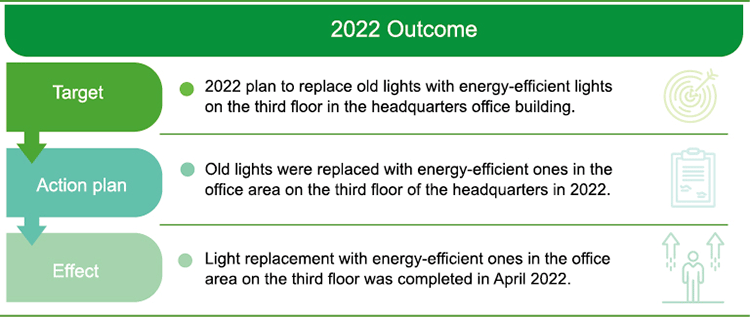

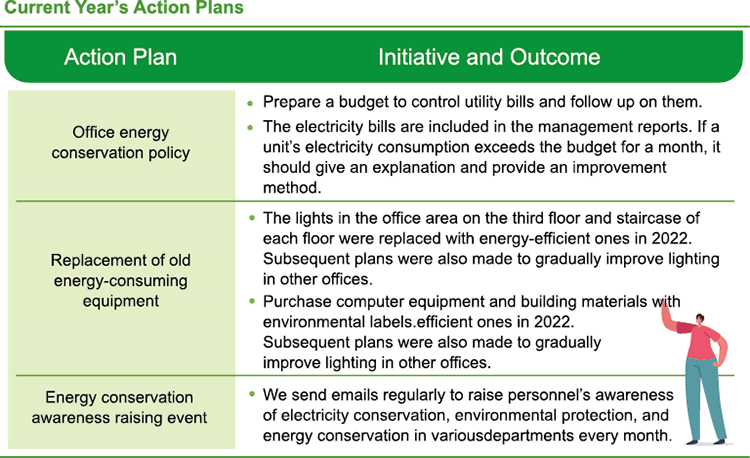

Current Year’s Action Plans

5.1.4 Climate Indicators and Goals

To further manage climate-related risks and opportunities effectively, PSC has chosen climate key performance indicators (KPIs) that have meaningful management implications to measure performance in Governance, Strategy, and Risk Management. The established climate KPIs also serve as a basis for setting climate-related goals. The regular review mechanism facilitates appropriate decision-making at the governance and management levels and enables responsible units to take further mitigation measures to reduce the potential impact of climate risks on the Company.

In 2022, PSC convened 3 integrated meetings where various aspects were discussed, including goal setting, progress monitoring, and performance reviews. The primary focus of these meetings was on environmental issues as follows.

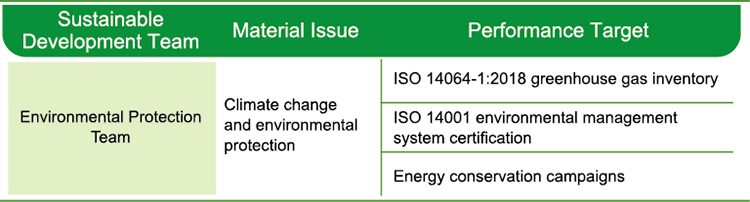

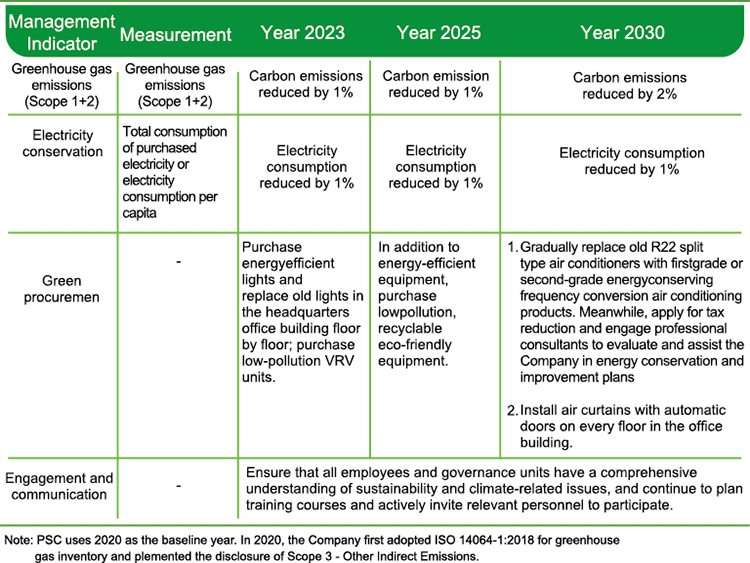

1. Summary of PSC’s indicators and targets

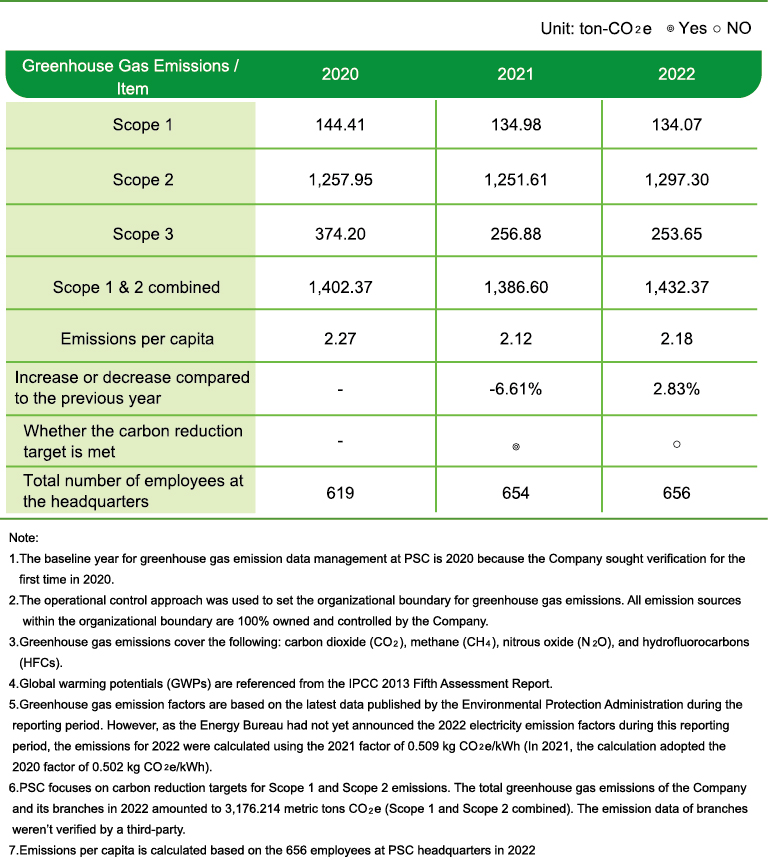

2. Greenhouse gas emissions

PSC adopted ISO 14064-1 for greenhouse gas inventory in 2019, covering Scope 1 and Scope 2 emissions, and obtained the third-party ISO 14064-1:2018 verification of greenhouse gas inventories from 2017 to 2020. Furthermore, in 2020, the scope was expanded to include Scope 3 emissions. According to the Company's greenhouse gas emission data, in 2022, due to the easing of the pandemic and employees returning to the office, along with an adjustment in the electricity emission factor, the carbon emissions per capita increased slightly compared to 2021. However, when compared to 2020, carbon emissions per capita decreased by 3.96%, indicating that carbon reduction efforts have been effective.

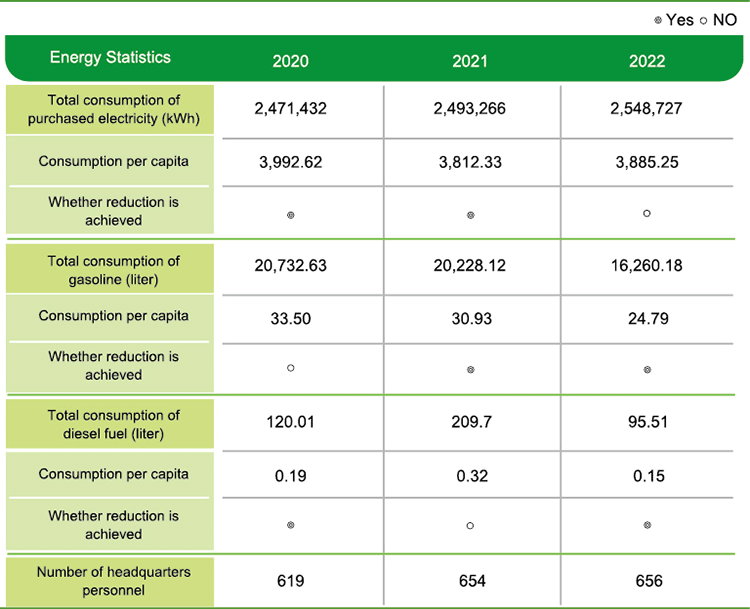

3. Energy Usage

Taking stock of PSC's actual electricity usage, the total consumption of purchased electricity in 2022 amounted to 2,548,727 kWh, marking a 3.13% increase compared to the baseline year of 2020. This increase was primarily attributed to the relaxation of pandemic-related remote working measures, leading to an overall rise in the Company's electricity consumption. However, the electricity consumption per capita still decreased by 2.69% compared to the baseline year of 2020 as a result of the Company's continued efforts to reduce energy consumption. In addition, the Company has plans to procure green energy from external suppliers to achieve future carbon reduction goals.

The statistics for gasoline and diesel usage suggest a significant decline in both categories in 2022 compared to 2020. The main reasons for this decrease are as follows.

● In terms of company vehicles, it is estimated that during the pandemic, employees reduced their outof-town business trips and instead opted for online meetings or public transportation, among other factors. Currently, the Company is gradually replacing company vehicles with hybrid cars to reduce carbon emissions.

● The usage of office building generators also decreased during the pandemic due to the implementation of split operations.

4. Internal Engagement and Communication

To achieve PSC’s climate sustainability goals and establish a comprehensive financial ecosystem, we are consistently in collaboration with external experts and consultants to design climate and sustainability-related courses. These courses are rolled out starting from relevant departments and expanded to cover all employees, aiming to enhance their understanding of sustainability and climate issues. Furthermore, recognizing that the implementation of climate strategies should be driven from the top down, with the active participation of the board of directors and senior management, we will provide governance and management units with relevant courses this year to facilitate policy implementation and achieve PSC’s climate mission.

Future Prospects

As a financial institution, PSC has a mission to exert its financial influence to expand the impact of sustainable investments, aspiring to become a positive force that drives sustainability across the industry chain and delivers significant added value to society and stakeholders. The Company is committed to taking proactive actions and incorporating sustainability governance mechanisms into its core operations to promote sustainable development and low-carbon transformation. In the future, PSC will continue to monitor international trends, update quantitative models, and establish more meaningful climate key performance indicators and goals to achieve its management objectives. It is our goal to present detailed analysis results and observations in a more rigorous and faithful manner. Moreover, we will continue to develop sustainable financial products and services, leveraging our brand advantage and key influence as a leader in the financial sector.